- Home

- Publications and statistics

- Publications

- Banque de France and ACPR Climate Action...

Banque de France and ACPR Climate Action Report

The Banque de France and the ACPR: two ambitious and resolute institutions in their contribution to the fight against climate change

Summary

-

1. Avant-propos du gouverneur

-

2. Notre méthodologie

-

3. Gouvernance

-

4. Stratégie

-

4.1 Le Changement climatique est au cœur de notre plan stratégique « Construire Ensemble 2024 »

-

4.2 Le risque climatique au cœur des mandats de la Banque de France et de l’ACPR

-

4.3 Une stratégie climat bâtie sur les risques et opportunités liés au changement climatique...

-

4.4 ... pour la stabilité monétaire

-

4.5 ... pour la stabilité financière

-

4.6 ... pour les services à l’économie et à la société

-

4.7 Encourager le verdissement du système financier

-

4.8 Un objectif interne de performance durable

-

-

5. Gestion des risques

-

5.1 Gestion des risques liés au changement climatique à la Banque de France et à l'ACPR : risques sur notre bilan et risques sur nos missions

-

5.2 Gestion des risques liés au changement climatique à la Banque de France : les portefeuilles de politique monétaire

-

5.3 Gestion des risques liés au changement climatique à la Banque de France : les portefeuilles non liés à la politique monétaire

-

5.4 Gestion des risques liés au changement climatique à la Banque de France et à l’ACPR : en tant que superviseur, veiller à la stabilité de la place financière

-

-

6. Métriques et cibles

-

7. Télécharger l'intégralité des publications

-

1. Avant-propos du gouverneur

-

2. Notre méthodologie

-

3. Gouvernance

-

4. Stratégie

-

4.1 Le Changement climatique est au cœur de notre plan stratégique « Construire Ensemble 2024 »

-

4.2 Le risque climatique au cœur des mandats de la Banque de France et de l’ACPR

-

4.3 Une stratégie climat bâtie sur les risques et opportunités liés au changement climatique...

-

4.4 ... pour la stabilité monétaire

-

4.5 ... pour la stabilité financière

-

4.6 ... pour les services à l’économie et à la société

-

4.7 Encourager le verdissement du système financier

-

4.8 Un objectif interne de performance durable

-

-

5. Gestion des risques

-

5.1 Gestion des risques liés au changement climatique à la Banque de France et à l'ACPR : risques sur notre bilan et risques sur nos missions

-

5.2 Gestion des risques liés au changement climatique à la Banque de France : les portefeuilles de politique monétaire

-

5.3 Gestion des risques liés au changement climatique à la Banque de France : les portefeuilles non liés à la politique monétaire

-

5.4 Gestion des risques liés au changement climatique à la Banque de France et à l’ACPR : en tant que superviseur, veiller à la stabilité de la place financière

-

-

6. Métriques et cibles

-

7. Télécharger l'intégralité des publications

Governor's foreword

One year ago, during the COP26 climate conference in Glasgow, the Banque de France and the Autorité de contrôle prudentiel et de résolution (ACPR) pledged to publish a report before the end of 2022 detailing their climate action and in accordance with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) (COP26: Pledge by the Banque de France/ACPR). In doing so, we are following through on our determination to act transparently with regard to the public and our peers, amid rising expectations on corporate extra-financial reporting, especially within the European Union (EU).

Helping to assess, mitigate and manage the impact of climate risks on the real economy and the financial system now forms, in our view, part and parcel of the mandate entrusted to central banks and supervisors, for both monetary strategy and financial stability. The Banque de France was among the first to act in encouraging the community of central banks and supervisors to recognise climate issues. Internationally, in 2017, it was one of the founding members of the Network for Greening the Financial System (NGFS), which now counts 121 members and for which the Banque de France acts as the permanent global secretariat. In terms of internal governance, we were one of the first central banks to set up a team that is totally focused on climate issues – our Climate Change Centre – which allows us to act even more effectively by nurturing new skills and unlocking synergies between business areas and activities. The pilot exercise of climate scenario analysis conducted by the ACPR in 2020-2021 in partnership with the entities under its supervision is another illustration of our resolve to take action. We are applying our ambitions across all of our tasks and embedding them in our corporate strategy, with tangible goals set for 2024.

We have been guided in the past by the work of the TCFD, which helped to shape the Responsible Investment Report that we have published annually since 2019. Now, we want to go a step further by integrating the full spectrum of activities undertaken by the Banque de France and the ACPR, including financial stability, the operations of our branch network, and our goal of reducing the carbon footprint of our activities.

In keeping with TCFD recommendations, this report begins by presenting the governance arrangements in place to manage climate issues, as well as the strategy developed in this area by the Banque de France and the ACPR, which is fully integrated into our overall strategy. The report then explains how the Banque de France manages the climate change risks identified within the scope of its missions. It concludes by describing a series of metrics and targets to measure the change in climate-relatedrisks related to our activity and, more broadly, the development of our climate action. As per the NGFS recommendations on central bank disclosure, this report takes a broad view by considering the impact of climate change on our balance sheet but also on our missions.

This is the first report of its kind for the Banque de France. Our aim is to publish again on a regular basis, gradually fine-tuning the scope and accuracy of this exercise, in line with the learning-by-doing approach that we have embraced since taking our first steps in this area. The report will be supplemented next year by a report on our euro-denominated non-monetary policy portfolios, in line with the common stance adopted by Eurosystem central banks.

Preparing this report has played a valuable role in galvanising the efforts already underway and in instilling a shared climate culture across all our activities. Governments have just met at the COP27 conference to accelerate the transition to carbon neutrality and bolster our resilience to climate change; the past 12 months have underlined – sometimes dramatically – the urgent need to act: I am pleased to reiterate once more, with this report, our steadfast support of efforts to meet the goals of the Paris agreement and promote sustainable finance.

François Villeroy de Galhau

Our methodology

1. The TCFD methodology is applied as interpreted by the NGFS guide for central banks. Specifically, we follow the four-pillar approach recommended by the TCFD, and take into account the impact of climate-related risks on our balance sheet as well as on our missions:

- Governance: the Bank’s governance arrangements for climate-related risks and opportunities

- Strategy: real and potential impacts of climate-related risks and opportunities for activities and actions taken to respond to these impacts

- Risk management: processes used to identify assess and manage climate-related risks

- Metrics and targets: metrics and targets used to assess and manage climate-related risks and opportunities

2. The report focuses on activities carried out by the Banque de France itself, referring to additional work at Eurosystem level where applicable

3. In its scope, the report is centred on climate risk management but may integrate elements relating to nature risk

4. It is a summary report, referring to more detailed publications where available

5. Metrics and targets associated with our objectives and actions: these metrics will be enhanced as our work advances and in accordance with data availability

Find out more

Governance

High-level governance implemented by each business area

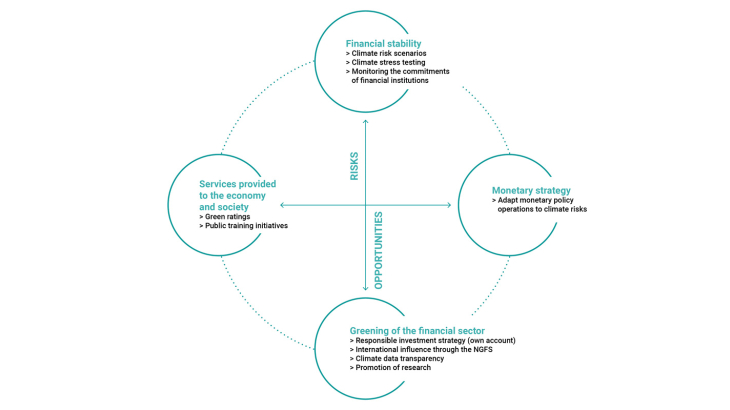

The Banque de France and the ACPR apply their climate strategy to all their key tasks, namely monetary strategy, financial stability, provision of services to the economy, and sustainability. Responsibility for coordinating and executing the strategy lies with governance bodies at several levels, ranging from senior management to operations.

A climate strategy defined by the Executive Committee

The Executive Committee, which includes the Governors and Directors General of the Banque de France and the Secretary General of the ACPR, sets broad guidance for the Banque de France to follow in terms of fighting climate change, as part of the process of drawing up the corporate strategic plan. It also oversees the consistency of the climate strategy applied across the different business areas.

The corporate plan and strategic guidelines are submitted for approval to the General Council, which is kept abreast of progress in implementing the climate roadmap. The College of the ACPR approves all publications by the supervisory authority on the topic of climate change and closely followed the development of the pilot exercise of climate scenario analysis in 2021 and 2022.

Initiatives designed to take account of climate change are also defined in conjunction with specific governance bodies, some of which are external, such as the Eurosystem Governing Council for monetary policy and the Single Supervisory Mechanism for banking supervision.

Coordination by the Strategic Committee for Sustainable Finance

The growing importance of climate change-related work has led to the establishment of new cross-cutting structures to ensure that the business areas are properly coordinated.

Established in 2020 under the chairmanship of Deputy Governor Sylvie Goulard, the Strategic Committee for Sustainable Finance is responsible for coordinating the Bank’s sustainable finance initiatives at international, European and domestic levels. The committee guides the work done in this area by the Bank and the ACPR and ensures its coordination with initiatives underway internationally, in Europe and in France.

Operational implementation by the Climate Change Centre

In April 2021, the Banque de France set up a Climate Change Centre (CCC), which was given three primary tasks:

- Coordinate the implementation of initiatives by the Banque de France and ACPR to take account of climate issues (excluding the CSR strategy)

- Analyse the risks associated with climate change for the financial sector, working closely with business experts from the two institutions

- Provide the permanent global secretariat for the NGFS

The CCC’s goal is to make the Banque de France’s actions even more effective by drawing on new skills and unlocking synergies between the Directorates General. The centre is also tasked with ensuring that the Bank’s work is aligned with international initiatives spearheaded by the NGFS. The CCC deepens and widens the roles assigned to the former Sustainable Finance Division set up in 2019, which has made the Banque de France one of the world’s very first central banks to have a team entirely devoted to climate issues.

The CCC is coordinated by the Executive Committee for Climate Change, which brings together all Banque de France Directorates General and the General Secretariat of the ACPR. This committee is responsible for drawing up the CCC’s work programme and making sure that the roadmap applied by the cross-cutting working groups moves forward on schedule.

Monetary policy and financial stability: coordinated initiatives at European level

Monetary policy-related work is conducted within the framework of the Eurosystem. The Banque de France was involved in drawing up the roadmap for greening the ECB’s monetary policy and is working to execute it according to the agreed-on timetable.

The ACPR’s financial stability-related activities are conducted at European level within the Single Supervisory Mechanism as regards microprudential supervision of the banking sector.

The ACPR Climate and Sustainable Finance Commission

Set up in October 2019 following the marketwide agreement of 2 July 2019, this commission is chiefly tasked with aiding the ACPR in monitoring the sustainable finance commitments made by the financial intermediaries under its supervision. Against this backdrop, it seeks to promote constructive dialogue with financial community stakeholders.

Every year, it publishes a joint report with the AMF's Climate and Sustainable Finance Commission on the commitments made by French financial institutions.

You can consult also

Strategy

Climate change is at the heart of our “Building 2024 Together” strategic plan

Climate change was one of six major challenges identified during the collective, forward-looking approach used to draw up our corporate plan. Adopted in 2021, “Building 2024 Together” seeks to strengthen our capacity to discharge our tasks (ensure monetary stability, preserve financial stability, provide services to the economy and society), while taking into account the consequences of these major challenges: it lists 30 new priority actions organised around four strategic objectives, the fourth of which is devoted to sustainable internal performance.

In all, five actions are focused on priority initiatives designed to get our institution ready for the physical and transition risks linked to climate change.

- Adapt monetary policy operations to climate risks

- Ensure the financial sector takes better account of climate-related risks

- Assess the feasibility of incorporating climate risks into the company ratings process

- Actively commit to carbon neutrality

- Aim for digital sobriety in all our digital uses

Deliverables for these five action areas are tracked by the indicators described in the chapter on metrics and targets.

The Bank has also pursued a corporate social responsibility (CSR) programme for many years. Among other things, it launched an ambitious responsible investment policy in 2018 with the publication of a Responsible Investment Charter, which it plans to develop further.

The Banque de France's strategy forms part of bold carbon emissions reduction targets adopted by the European Union (EU) and aimed at cutting emissions levels by 55% by 2030 relative to 1990 and achieving carbon neutrality by 2050. The Eurosystem is making an extensive contribution to these efforts and aims to align its actions with advances in the EU's policy and initiatives in this area.

Find out more

Climate risk at the heart of the mandates entrusted to the Banque de France and the ACPR

The physical and transition risks associated with climate change are a source of financial risk. Central banks and supervisors must recognise this risk and work to mitigate it within the framework of their mandates, while having a decisive impact on the development and promotion of sustainable finance. All the Banque de France’s tasks are thus concerned, from monetary strategy and financial stability to the services provided to the economy and society. The Bank is also applying a strategy aimed at exerting influence to promote a greener financial sector. Meanwhile, as a company, it is working to meet the goal of operating sustainably, which it applies to the management of its resources and own account investments.

A climate strategy built on climate-related risks and opportunities...

Monetary strategy

Action 3. Adapt monetary policy operations to climate risks:

- exert influence on the ECB’s monetary policy strategy review, especially the climate portion;

- participate in the first climate stress test of the Eurosystem balance sheet;

- more effectively integrate the climate transition in the assessment of risks to price stability;

- build a climate dimension into macroeconomic models and conduct scenario analyses Incorporate climate risk in monetary policy operations.

Financial stability

Action 11. Ensure the financial sector takes better account of climate risk, notably via the NGFS:

- promote international cooperation between central banks and supervisors, notably through hosting the NGFS secretariat;

- adapt the ACPR’s climate stress testing methodology to the European level;

- continue to track the climate commitments of French institutions;

- promote the publication of transition plans by financial institutions;

- include climate risks in prudential requirements, maintaining a risk-based approach;

- better assess the financial impact of nature-related risks.

Services provided to the economy and society:

- Financial literacy (EDUCFI policy): Conduct initiatives to educate the general public and raise awareness about sustainable finance

Action 12. Assess the feasibility of incorporating climate risks into the company ratings process:

- develop a prototype indicator to assess how companies are doing in terms of their exposure to and control of climate risks

Sustainability

- Align the equity component of the own funds and pension liabilities portfolios with a 2°C trajectory, to be progressively lowered to 1.5°C.

Action 22. Actively commit to a target of carbon neutrality:

- actively commit the Banque de France to a pathway to carbon neutrality, setting intermediate goals for 2024 and 2030;

- educate employees in climate issues and the Banque de France’s environmental footprint.

Action 23. Aim for digital sobriety in all our digital uses.

... for monetary stability

Climate lies at the heart of our monetary mandate because of its effects on price stability. The transition to a low-carbon economy, spurred notably by the introduction of transition policies and technological developments, may feed through to activity and prices, starting with energy prices. Besides transition risks, extreme events linked to climate change are having increasingly visible effects on economic activity and prices, especially in the food sector.

The Banque de France is therefore backing the Eurosystem's strategy to ensure that monetary policy is more effective in taking climate issues into account. This is being done through improved integration of the climate transition in assessments of risks to price stability, notably in macroeconomic models, and through climate scenario analyses.

... for financial stability

Under their financial stability mandates, the Banque de France and the ACPR are taking steps to better understand the exposure of France's banking and insurance sectors to these risks and to ensure that they are capable of facing up to them. From a micro and macroprudential supervisory perspective, the main climate-related risks are the climate risks borne by French institutions. These risks therefore need first to be assessed more effectively through the long-term forward-looking view afforded by stress testing of banks and insurers. The question of additional capital requirements could be raised once all the risks are known, at French and European levels, and supplemented by the publication of transition plans of individual institutions.

The Banque de France and the ACPR are prioritising efforts to standardise climate stress tests and make them more reliable, in order to promote their widespread use as supervisory tools. Assessing the financial risks posed by climate change will also entail strengthening collaboration with the academic world by taking a multidisciplinary approach to the most relevant issues for the financial sector. The scope of risks being researched needs to be widened gradually beyond climate risk to include the impacts on the financial sector of risks related to nature and biodiversity loss.

... for services provided to the economy and society

The Banque de France rating provides an expert assessment of a firm’s short-/medium-term financial trajectory. Over 300,000 companies were rated in 2021.

Beyond the analysis of financial statements, default risk is assessed by identifying forward-looking aspects that could influence the company's situation. The Banque de France has undertaken work to recognise climate risks more effectively in corporate risk default assessments. Companies are getting ready for the energy transition, adjusting their business models and organising themselves to respond to market and regulatory demands for enhanced extra-financial disclosures, notably with the implementation of the Corporate Sustainability Reporting Directive (CSRD) from end-2024 for large companies. Accordingly, ratings will need to change to reflect these developments if they are to remain a reliable gauge of the economic and financial situation of companies. With this in mind, a prototype climate indicator to assess companies’ exposure to and control of climate risks will be built for internal use at the end of 2022.

France has had a national strategy for economic, budgetary and financial literacy (EDUCFI) since 2016. The Banque de France is in charge of implementing this strategy nationwide. The EDUCFI strategy is being executed through information and training initiatives designed to help people improve their practical understanding of financial topics. The fight against climate change is one of the subjects covered during presentations to student groups and in the resources made available to the public, particularly through a series of practical economic guides (ABC de l’économie) covering green finance, responsible finance and corporate social responsibility.

Find out more

Guide to sustainable finance

Outils statistique

Guide to green finance

Outils statistique

Guide to green bonds

Outils statistique

Guide to the EU green taxonomy

Outils statistique

Guide to responsible finance

Outils statistique

Economic guide to corporate social responsibility

Outils statistique

Promote a greener financial system

Climate change and the policies put in place to support the transition to a low-carbon economy are leading to a deep transformation of the economy. As a public institution, the Banque de France is involved in adopting and setting up an appropriate regulatory framework, to enable it to continue discharging its tasks. By virtue of its positioning within the financial ecosystem and at the heart of the French and European economy, the Banque de France can also use its influence to promote a greener financial sector, at home and abroad.

With this in mind, the Banque de France is prioritising continued efforts to invest for the NGFS, which is producing leading-edge work at international level on the procedures used by central banks and supervisors to integrate climate risk. A founding member of the network, the Banque de France acts as its secretariat, providing around 15 employees and hosting experts seconded from NGFS member institutions.

To analyse the financial risks linked to climate change, standardised and comparable data on company performances are needed. The Banque de France and the ACPR are involved in work at European and international levels to build an extra-financial reporting framework. They are promoting European disclosure standards for climate risk exposure that can be transposed to the international level, while supporting their proper application at domestic level.

As an investor, the Banque de France can also be part of helping to foster greener financial markets. In this regard, the financing needs linked to the climate transition are enormous, with at least EUR 350 billion in additional annual investment needed to meet Europe’s goal by 2030. The responsible investment approach adopted by the Banque de France since 2018 for a portion of its portfolios illustrates how an investor can implement this kind of approach and in so doing have a knock-on effect on the wider community of central banks and investors; with this experience, the Bank has also gained a better understanding of the practical issues and challenges entailed in putting such an approach into practice, allowing it to make a richer contribution to national and international discussions on ways to promote a greener financial system.

Research plays a decisive role in better understanding the financial issues linked to the effects of climate change, but also in exploring ways forward in terms of recognising these issues in the activities of the Banque de France and the ACPR. The in-house “Climate Research network” is pursuing an ambitious research agenda bringing together researchers from across all the Directorates General. Over 50 research projects are being conducted internally. Also, since 2019, the Banque de France has awarded prizes to young researchers working on green finance.

Find out more

Targeting sustainability

In addition to discharging its tasks as a central bank and supervisor, the Banque de France is also acting under its own corporate responsibility and is targeting sustainability by taking account of climate risks for its own activities and curbing the climate impact of its physical operations and investments. The Bank has pursued a corporate social and environmental responsibility policy for many years. It is now its focusing on its own corporate actions, complementing the work done under its central banking and supervisory responsibilities.

The Bank is actively working towards carbon neutrality through an approach designed to slash its own greenhouse gas (GHG) emissions, with intermediate milestones set for 2024 and also 2030 (currently being determined). This ambitious programme is being taken forward by keeping up the reduction efforts underway since 2014 and proposes a new milestone for 2024 that will be decisive in achieving this goal. Specifically, GHG emissions across the Bank’s scope of operations are to be cut by at least 10% in 2024 relative to 2019. The programme is also based on a climate strategy that is consistent with the Paris Agreement and that activates all possible drivers, including setting a low-carbon trajectory through the 2030 milestone. It also integrates the development of new tools needed to steer these aspects in a robust and granular manner.

The Banque de France monitors the climate-related risk exposure level of its own funds and pension liabilities portfolios. It reports on this exposure in a specific report that draws on risk measures prepared by external service providers. The Banque de France’s Responsible Investment Report goes into greater detail about the identified risks.

The Banque de France is also committed to training staff through the development and deployment of training programmes intended to improve the workforce's understanding of questions relating to the climate and to sustainability more broadly. During the COP26, it set itself the target of training at least 50% of all employees by 2024.

Risk Management

Management of climate-related risks at the Banque de France and the ACPR: risks to our balance sheet and risks to our missions

In accordance with the strategy described in the previous chapter, the Banque de France seeks to assess and manage the impact of climate-related risks on both its balance sheet and its missions.

The inclusion of climate-related risks in monetary policy at Eurosystem level is a central plank of this approach, not just because of the impact of climate change on price stability, but also because of the share of the Eurosystem balance sheet represented by monetary policy portfolios. The ECB's monetary policy strategy review, which wrapped up in July 2021, and the implementation of the goals of the shared climate action plan, seek to improve recognition of the impact of climate change and the low-carbon transition on our price stability mission and its operational application. Meanwhile, climate stress testing will enable the Eurosystem to measure its own exposure to climate change risks more effectively.

In non-monetary policy portfolios, the Banque de France began applying a responsible investment approach to its own funds and pension liabilities portfolios in 2018. As such, it monitors and manages the climate-related risks to which these portfolios are exposed. In accordance with the common stance adopted by Eurosystem central banks, the Banque de France will shortly adopt a climate reporting approach covering all euro-denominated non-monetary policy portfolios.

In its capacity as supervisor, the ACPR acted early to identify climate change risks, conducting its first pilot climate exercise in 2020. This approach is now being taken forward within a European framework, including through an exercise by the SSM in 2022. Coupled with efforts to monitor and assess the climate commitments of members of the financial community, these measures aim to encourage better recognition of climate-related risks by the French banking and insurance sectors.

Management of climate-related risks at the Banque de France: monetary policy portfolio

ECB monetary policy strategy review

Euro area monetary policy is determined by the Governing Council of the ECB and implemented jointly on a decentralised basis by the ECB and national central banks. Following a strategy review, on 8 July 2021 the ECB adopted and published its new monetary policy strategy, which included a climate action plan. Acting within the framework of the ECB's mandate, the Governing Council committed itself to considering all the implications of climate change and the low-carbon transition in its monetary policy and central banking tasks.

After making a major contribution to the strategy review that ended in July 2021, the Banque de France is continuing to play a driving role within the Eurosystem in implementing the objectives of the shared climate action plan. The Building 2024 Together corporate plan links Eurosystem objectives to those of the Banque de France via Action 3.

On 4 July 2022, the ECB communicated on concrete steps taken to consider climate change in its corporate bond purchases, collateral system, reporting requirements and risk management.

Efforts to green the Eurosystem's monetary portfolios

Drawing on its experience with the responsible investment policy for non-monetary policy portfolios, the Bank is contributing to work by the Eurosystem on ways of greening monetary policy portfolios comprising corporate bonds (CSPP).

The Eurosystem wants to gradually decarbonise its corporate bond holdings, on a path aligned with the goals of the Paris Agreement. To this end, it will tilt these portfolios towards issuers reporting better climate performance by reinvesting the redemptions expected over the coming years. Better climate performance will be characterised by lower greenhouse gas emissions, more ambitious carbon reduction targets and better climate-related disclosures.

Tilting means that the share of assets on the Eurosystem’s balance sheet issued by companies with a better climate performance will be increased compared to that by companies with a poorer climate performance. This aims to mitigate climate-related financial risks on the Eurosystem balance sheet. It also provides incentives to issuers to improve their disclosures and reduce their carbon emissions in the future.

The ECB expects these measures to apply from October 2022. The ECB will start publishing climate-related information on corporate bond holdings regularly as of the first quarter of 2023.

In any case, the volume of corporate bond purchases will continue to be determined solely by monetary policy considerations and their role in achieving the ECB’s inflation target.

The ECB is conducting climate stress tests of the Eurosystem balance sheet in 2022 to assess the Eurosystem’s risk exposure to climate change, leveraging on the methodology of the ECB’s economy-wide climate stress test. Drawing on experience gained in adapting the ACPR’s pilot exercise, the Banque de France took part in the Eurosystem's work to determine the methodology. The ECB is scheduled to release the initial aggregate results in early 2023.

Management of climate-related risks at the Banque de France: non-monetary policy portfolios

Climate-related risks to the Banque de France balance sheet are integrated in our overall risk management approach

The Risk Committee determines and monitors the risk oversight framework for the Banque de France’s own-risk market operations (see footnote). The Operations Risk and Compliance Directorate, which is in charge of the secretariat for this committee, ensures that the framework is implemented. The Risk Director sits on the Assets-Liabilities Committee, the Pension Plan Strategic Committee and the Investment Committees, ensuring that risks are effectively taken into account in strategic and tactical investment decisions.

Acting on the fact that climate risk is a factor in financial risk, the Risk Committee requires this risk to be incorporated in the assessment and analysis of credit and market risks relating to operations. Since 2021, the committee has devoted at least one of its annual meetings entirely to climate risk. For example, in 2021, the Risk Committee held a specific meeting on taking climate risks into account in the Bank's risk management system, with a view to strengthening the integration and monitoring of these risks in the portfolios of assets managed for own account (non-monetary policy). The Risk Committee also reviewed the methodology and results of the first round of climate stress tests conducted in 2021.

Footnote: The Governing Council has responsibility for the financial risks associated with monetary policy instruments, which are shared between Eurosystem members. Operational and cybersecurity risks are subject to specific governance arrangements.

Responsible investment policy

The Banque de France has pursued a responsible investment (RI) approach since 2018. It first adopted an RI Charter, followed by a three-pronged strategy covering climate issues, environmental, social and governance (ESG) questions more generally, and engagement with companies in which it is a shareholder. This approach covers the own funds and pension liabilities investment portfolios, i.e. assets for which the Banque de France is solely and fully responsible. These portfolios were worth EUR 23 billion at 30 November 2021.

The Banque de France's responsible investment strategy involves monitoring and steering the climate risks (physical and transition risks) to which the asset portfolios are exposed (see Pillar 1 below). Physical risks, such as heat stress, are measured using a composite forward-looking indicator covering sovereign issuers and the entire value chain of portfolio companies. Exposure to transition risk is measured based on the share of revenue that portfolio companies derive from fossil fuels. In addition, the responsible investment strategy is integrated in the three lines of defence of the Banque de France's risk management system. As part of this, all listed and unlisted vehicles in which the Bank invests are submitted for approval to the Risk Committee.

Find out more

Management of climate-related risks at the Banque de France and ACPR: As supervisor, ensure the stability of the financial centre

Early steps to identify climate-related risks

The ACPR’s work on climate risk began in 2015 in the context of implementing France’s Environmental Transition and Green Growth Act, which established a strict extra-financial disclosure framework for institutional investors. Following the publication of two initial reports in 2019 on the exposure of banks and insurers to climate risk, two task forces were set up with the industry to look at climate risk governance and scenario analysis. This led to the release of two best practice guides on climate risk governance and management for banks (2020) and insurers (2022). Work on scenarios paved the way for a pilot exercise of climate scenario analysis. The first of its kind and scale, the exercise was conducted in the two sectors and drew on the initial scenarios published by the NGFS.

Follow-up on the pilot climate exercise

In 2020, the ACPR organised a pilot climate exercise, which functioned as a stress test of climate-related financial risks through to 2050. The findings were published in May 2021. The ACPR teamed up with 9 banking groups and 15 insurers, representing 85% and 75% respectively of the French market, to stage a full-scale and stringent assessment of climate-related risks. This exercise illustrates the driving role played by France’s authorities and the Paris financial community, as well as the progress made in efforts to stop global warming since 2015.

The pilot exercise found French banks and insurers to be moderately exposed overall to climate-related risks. But considerable efforts are still needed to help to significantly reduce greenhouse gas emissions by 2050 and thus contain the temperature trajectory between now and the end of the century.

The exercise was innovative in a number of ways, including its application to the two sectors (banking and insurance), its attempt to assess interactions through risk transfer mechanisms, in its degree of geographical and sector granularity, and in the dynamic balance sheet assumptions used to assess the strategies of individual institutions. To date, it is the only exercise that has also integrated the health risks linked to global warming. This exercise had a galvanising effect on French financial institutions and was a major influence on the work of other supervisors, including the ECB.

The innovations of ACPR pilot climate exercise :

|

Short-term, medium-term and long-term risk assessment horizon |

Innovative methodologies (scenario analysis applied at sector level) |

Innovative assumptions (dynamic balance sheet in particular) |

Coverage of physical and transition risks |

|

Beyond the methodological findings, two key risk-related takeaways:

- Vulnerabilities associated with physical risk are far from insignificant: based on information provided by insurers, the cost of claims could increase by between five and six times in some French départements between 2020 and 2050;

- Financial institutions were able to assess corrective actions (exits from some sectors, for example) and take note of new risks: potential mismatch between exit strategies for certain GHG-emitting activities and the goal of maintaining market share, financing the economy or maintaining customer relationships, potentially resulting in longer-than-expected exposure to transition or physical risks.

Pan-European stress tests

In January 2022, the ECB announced the launch of a prudential stress test covering climate risk, to assess banks’ readiness to withstand the economic and financial shocks that these risks could trigger.

The Banque de France and the ACPR made a significant contribution to efforts to prepare this cross-European exercise, providing the SSM with the experience gained at national level.

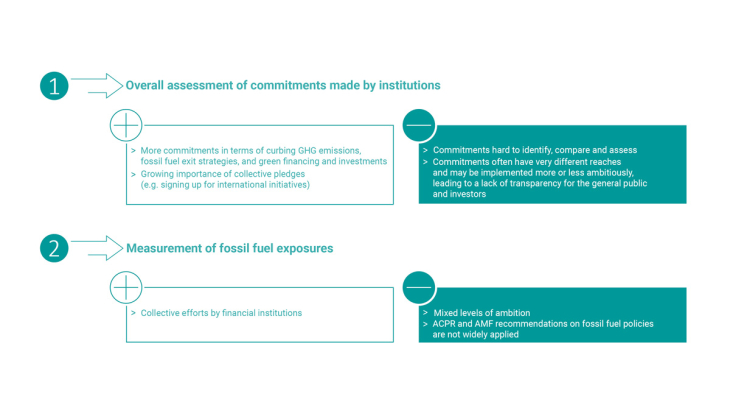

Joint ACPR-AMF report on monitoring and assessing the climate commitments of members of the financial centre

Working through their respective Climate and Sustainable Finance Commissions, the ACPR and the AMF published three joint reports, in 2020, 2021 and 2022, based on publicly available information and questionnaires sent to key players in the Paris financial community, supplemented by numerous bilateral exchanges and analyses using internal data held by the two authorities.

Regarding the exposure of financial institutions to fossil fuels, the authorities believe that institutions need to work harder to recognise these exposures more robustly, transparently and uniformly, and that efforts should be concentrated in the first place on capturing the entire value chain and the widest possible business scope.

The ACPR and AMF also said that financial institutions should do more to establish formal customer support and shareholder engagement policies, and that the impact of employee training should be more clearly detailed or assessed.

The most recent joint report, which was published in late October 2022, also found that previously noted efforts have stalled. The authorities therefore called on financial institutions to act swiftly to close the gap between the currently observed level of transparency on voluntary engagements and the requirements arising from regulations currently being applied or still to come.

Find out more

Metrics and targets

A first set of indicators designed to measure the risks both to our balance sheet and tasks

A list of metrics and targets that is under construction

A stringent risk assessment and management approach relies on metrics that may be used to objectively measure the change in risks and to determine whether these developments are aligned with the institution's governance, strategy, risk management policy and any targets adopted. In accordance with their holistic approach to climate-related risks, the Banque de France and the ACPR plan to develop a set of metrics to assess not just the risks to their balance sheet but also the impact of climate-related risk on their tasks.

Reflecting a climate risk management approach that is designed to get better year on year, the list of metrics to follow is itself set to evolve. In particular, it is important to recognise the current limitations inherent in climate data, including data gaps, data that are still being standardised, the involvement of external service providers, and ongoing harmonisation of the methodologies used by different indicators.

Building in the European dimension

The Banque de France is contributing actively to the Eurosystem’s work on integrating climate issues in monetary policy; metrics relating to these efforts will be published at the level of the Eurosystem and are therefore not included in this report.

Regarding euro-denominated non-monetary policy portfolios, methodological work is currently being conducted within the Eurosystem to make the climate reports published by central banks more comparable. This work is expected to result in an initial publication of climate metrics for these portfolios in 2023.

The following list of metrics therefore represents a first stage, which is set to be expanded based on internal and external work and developments in climate data. With these metrics, and the targets adopted for its own carbon emissions and activities, the Banque de France and the ACPR intend to play a full part in the climate transition, both through their own activities and in the discharge of their tasks.

Financial stability

Level of exposure of French financial institutions to climate-related risks

|

2021 |

|

|

Exposure of French financial institutions to sectors with the greatest exposure to climate transition risks, as a % of total assetsa |

11% for the banking sector

9% for the insurance sector

|

French institutions’ degree of readiness

|

2021 |

|

|

Institutions that took part in the last round of stress tests organised by the ACPR, as a % of the sector |

85% of the banking market

|

Climate commitments of French institutions

|

|

2021 |

|

Institutions publishing a fossil fuel policy, including a coal exit date, as a % of total assets |

85% for the banking sector

|

a Based on a scope comprising sectors identified as sensitive (names and codes as per the European Community's statistical classification of economic activities (NACE)): Crop and animal production, hunting and related service activities A01; Mining and quarrying B; Manufacture of coke and refined petroleum products C19; Manufacture of chemicals and chemical products C20; Manufacture of other non-metallic mineral products C23; Manufacture of basic metals C24; Sewerage, Waste collection, treatment and disposal activities, Remediation activities and other waste management services E37-39.

Services provided to the economy

Financial literacy

|

2021 |

2022T1/T3 |

Target |

|

|

Number of consultations of short (ABC de l'économie) connected with the fight against climate change |

7 512 |

11 000 |

|

|

Number of climate risk presentations to student groups |

20 |

21 |

|

Financial analysis of companies

| 2021 | 2022 T1-T3 | Target | |

| Assess the feasability of integrating a climate risk indicator into the company ratings system | Prototype tested on a sample of 50 or so companies from three different sectors |

Prototype end-2022 |

Sustainability

Responsible investment policy: goal of aligning the equity components of own funds and pension liabilities portfolios with a 2°C trajectory, to be progressively lowered to 1.5°C

Pillar 1: Align investments with France’s climate commitments

| 2021 | |

| Objective No. 1: Align equity components with a 2°C trajectory. Horizon set at end‑2020 for the own funds portfolio and end‑2022 at the latest for the pension liabilities portfolio | Equity component of the own funds portfolio 2°C aligned from end‑2019; same for the pension liabilities portfolio from end‑2021 |

| Objective No. 2: Contribute to financing the energy and ecological transition (EET) by increasing investment in green and social bonds and in thematic funds with an EET focus from 2019 |

EUR 1.6 billion invested in green bonds

EUR 355 million invested in EET thematic funds |

Pillar 2: Include environmental, social and governance (ESG) criteria in asset management

| 2021 | |

| Objective No. 3: Equity components meeting the requirements of Pillar III of the French SRI label in 2019 | 20% of equity issuers excluded on the basis of ESG criteria from end-2019 |

| Objective No. 4: Step up exclusions of issuers involved in fossil fuels |

From 2021, issuers that generate over 2% of revenue from thermal coal or 10% from unconventional hydrocarbons will be excluded

At end‑2024, the coal threshold will be lowered to 0%, and thresholds will kick in for oil (> 10% of revenue) and gas (> 50% of revenue) |

Pillar 3: Exercise voting rights and engage with issuers

| 2021 | |

| Objective n° 5: Adopt a voting policy that includes extra financial provisions in 2019 | Voting policy adopted in 2019 and adjusted in 2020 to reflect new fossil fuel exclusions |

| Objective n° 6: Achieve a general meeting attendance rate of at least 80% from 2021 onwards |

Attendance rate of 90% at end-2021

|

All metrics are available in the Responsible Investment Report, which is posted online (see “Find out more”).

Find out more

Social and environmental responsibility: aim to significantly reduce our GHG emissions in order to be on a carbon neutral pathway

Social and environmental responsibility

| 2019 | 2021 | Variation 2021/2019 | Target | |

|

Total greenhouse gas (GHG) emissions within operational scope (energy, fugitive emissions, commuting, business travel, waste)1 |

41.938 | 35.777 | -14,7 % | Reduction of GHG emissions by -10% in 2024, relative to 2019 |

| Scope 1 (direct emissions of GHG)1 | 13.795 | 12.604 | -8,6 % | |

| Scope 2 (indirect emissions linked to energy)1 | 6.541 | 5.983 | -8,5 % | |

| Scope 3 (other indirect emissions of GHG – excluding financial investments)1 | 21.602 | 17.190 | -20,4 % | |

| Carbon footprint of the information system2 | 3.318 | 3.208 | -3,3 % | |

| Decision to take account of extra-financial criteria when reviewing Banque de France investment projects, with implementation from 2022 and targeting 100% for “major projects”, 100% for new IT projects and at least 50% for other investment projects | 7 pilot projects |

|

2022 Mise en œuvre pour 100 % pour la catégorie "grand projet", 100 % pour les nouveaux projets informatiques, et au moins 50 % pour les autres projets d'investissement |

1 GHG emissions, in tonnes of CO2 e, calculated using the regulatory BEGES methodology.

2 GHG emissions, in tonnes of CO2 e, calculated using the Life Cycle Assessment methodology.

Improve our understanding of climate issues

Research

| 2021 | 2022 Q1/Q3 | Target | |

| Contribution by Banque de France and ACPR researchers to climate and environmental topics | 10% | 15% | Research work on climate and environment to account for at least 15% of annual publications from 2022 |

Capacity building

| 2021 | 2022 T1/T3 | Target | |

| Number of Banque de France employees trained in climate-related questions | 29% | 50% of employees trained in 2024 | |

| Number of participants in IBFI training, for foreign central banks, in connection with the fight against climate change | 593 |

Download the report

Updated on the 25th of July 2024